pay indiana unemployment tax online

Premium federal filing is 100 free with no upgrades for premium taxes. File online using IN Tax.

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Business entities that have paid wages in Indiana and met employer qualifications are required to register with the Indiana.

. As a reminder individuals must apply for unemployment benefits online using a computer tablet or smart phone. Pursuant to 20 CFR 60311 confidential claimant unemployment compensation information and employer wage information may be requested and utilized for other governmental. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers.

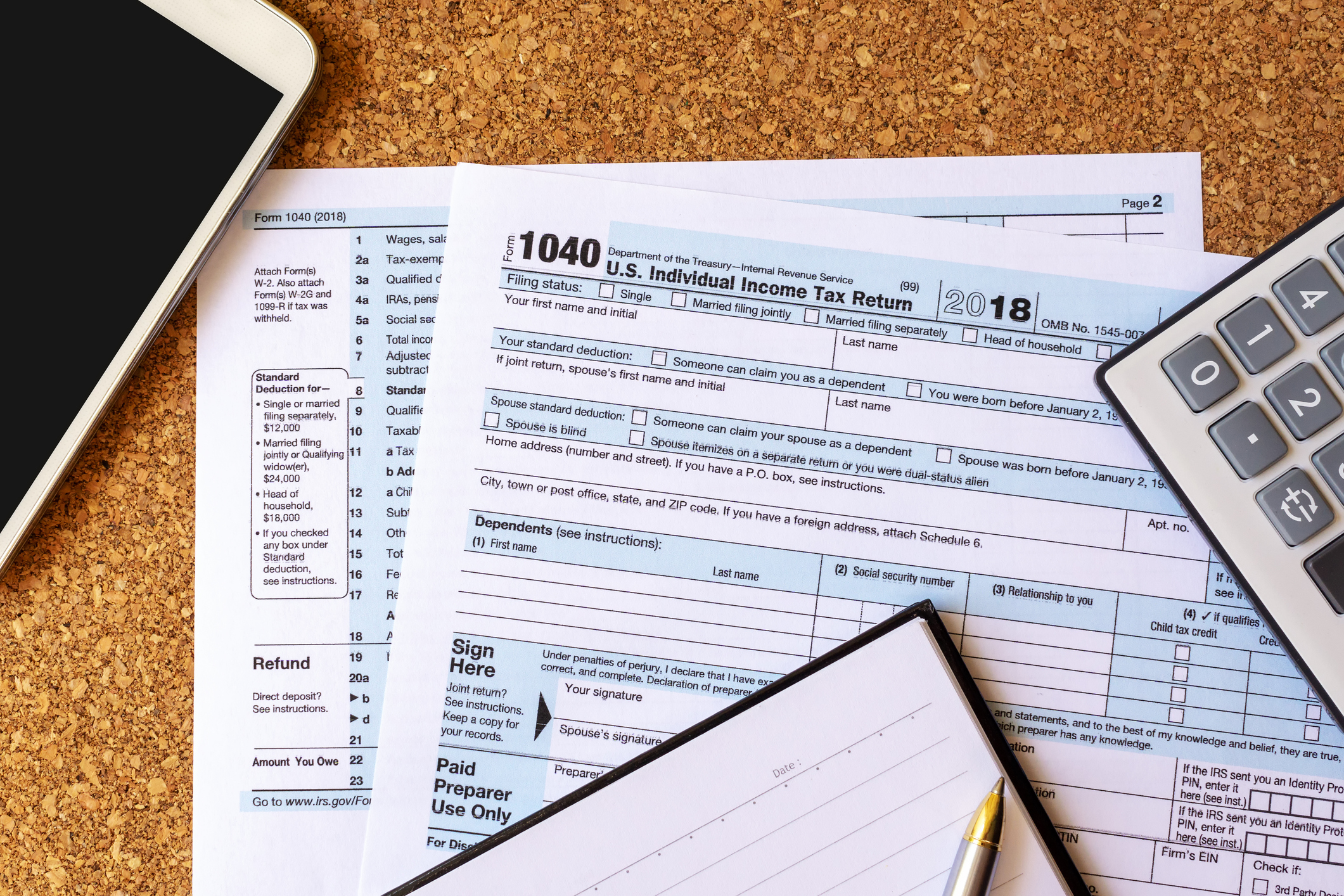

Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. I need to file my 2020 Indiana individual income tax return and plan to file electronically or prepare my tax return using tax softwareonline services. Online filing information can be found at wwwUnemploymentINgov.

To enroll in EFTPS call 1-800-555. Submit quarterly unemployment insurance contribution reports. These tax types will transition to INTIME DORs e-services portal at intimedoringov where customers will be able to file make payments and manage their tax accounts beginning July.

Payment Plan Set up a payment plan online INBIZ Indianas one-stop resource for registering. Indiana Tax ID Number. Welcome to INtax.

Those who used tax preparation software or online services to file prepare returns for mail-in or file electronically should check to see that the company updated its software to add back unemployment income excluded from the federal. Indiana also accepts in-person. This option is to pay the estimated payments towards the next year tax balance due.

Unemployment Insurance is a program funded by. To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by.

Search for your property. Form WH-3 Annual Withholding Tax. Electronic Payment debit block information.

In indiana these funds come from a tax that employers must paycalled unemployment taxesthat are collected by the state and paid out to workers who have lost. Ad File your unemployment tax return free. You can also pay FUTA taxes online and get confirmation of your payment using the IRS Electronic Federal Tax Payment System EFTPS.

Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically. 124 Main rather than 124 Main Street. Employers will pay an effective tax rate of between 535 and 998 on the first 9500 in annual wages paid to each employee.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account. Online Payment Service by VPS This service allows you to pay your Indiana Department of Workforce Development payments electronically and is a service of Value Payment Systems. Conduct an ongoing job search.

This must be completed for OnPay to be able to file and pay your Indiana taxes. Search by address Search by parcel number. Through the Uplink Employer Self Service System you have access to on-line services 24 hours a day 7 days a week.

100 free federal filing for everyone. For best search results enter a partial street name and partial owner name ie. You can find your Indiana Tax ID number on.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one. Search by address Search by parcel number. To make payments toward a previous tax year filing please select or link to the Individual Tax.

Registering for an Indiana State Unemployment Tax Account. You can apply for Indiana unemployment benefits online. To make payments toward a previous tax.

Create an account on Uplink CSS Indianas benefits system to submit your claim. So for each employee the company employs the company will. Individual Estimated IT-40ES Payment.

Up to 25 cash back In Indiana UI tax reports also known as premium reports and payments are due on or before the last day of the month following the end of each. 2021 Taxable Wage Base Base per worker will remain at 10800 per worker. Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status.

Kentucky employers are eligible to claim the full FUTA credit of 540 when filing your 2020.

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

No State Income Tax Relief For Unemployed Hoosiers In Bill Headed To Holcomb

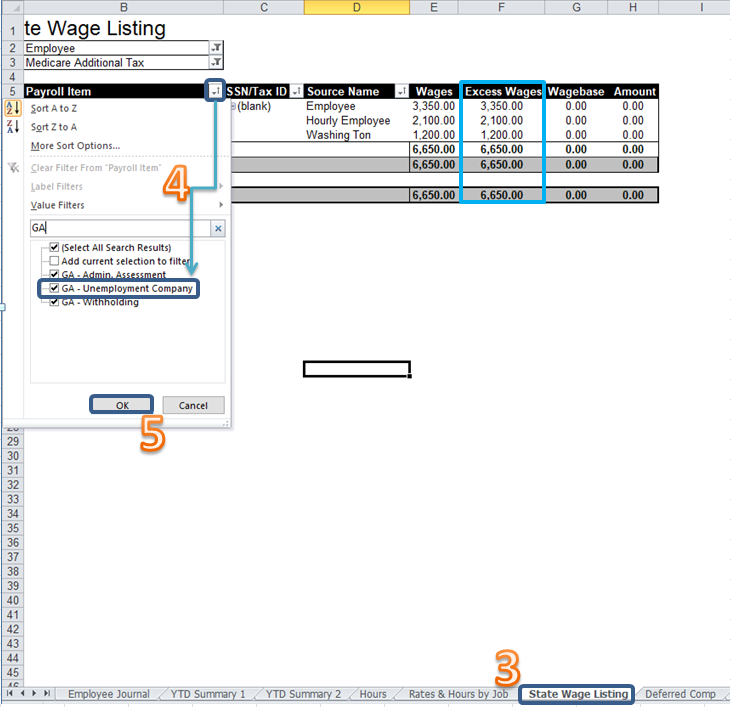

Solved Indiana Withholding Setup In Quickbooks Payroll

Suta Tax Your Questions Answered Bench Accounting

How To File Your Quarterly Wage Report And Unemployment Tax Return Kansas Department Of Labor Youtube

Dwd Will Collect Unemployment Overpayments From Tax Refunds

Is Unemployment Compensation Going To Be Tax Free For 2021

When Will Irs Send Unemployment Tax Refunds Wthr Com

What Do I Do If Someone Applies For Unemployment Under My Name Transunion

India Tea Production 2017 Tea West Bengal India

Solved Creating State Sui E File

Local Market Review January 2019 Housing Data Indiana Snapshots Brownsburg

Ess Employer Self Service Logon

Important Tax Information About Your Unemployment Benefits Wbiw

Millions Of Americans Won T See Their Tax Refunds For Months Time

H R Block Review 2022 Pros And Cons

Blue Springs Tax Preparation For Business Owners Your Tax Preparation Needs Are As Individual As You Are Alliance Financi Tax Attorney Tax Lawyer Tax Refund

Centering Workers How To Modernize Unemployment Insurance Technology