fundamental risk affects closed end funds in which of the following ways

Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments. 10 Best Closed-End Funds.

Open Ended And Evergreen Funds In Venture Capital Toptal

This is usually attributed to one of the following causes.

. Closed-end funds unlike open-end funds are not continuously offered. Every saving and investment product has different risks and returns. Get Answers Now Today.

Shares of closed-end funds frequently trade at a market price that is a discount to their NAV. In general as investment risks rise investors seek higher returns to compensate themselves for taking such risks. Funds the following factors among others could cause.

We researched it for you. When selling an open-end fund the price the seller receives is established at the close of the market when the NAV is calculated. Closed-end funds may trade at a discount or premium to their NAV and are subject to the market fluctuations of their underlying investments.

The major risk in risk management is that a risk occurs and there is not enough time in the schedule or money in the budget. Which of the following combines some of the operating characteristics of an open end fund with some of the trading characteristics of a. A n ____ sells fund shares either directly to the public or through authorized dealers.

Find Out What You Need To Know - See for Yourself Now. Closed-end funds are subject to management fees and other expenses. In finance risk refers to the degree of uncertainty andor potential financial loss inherent in an investment decision.

BlackRock will update performance and certain other data for the Funds on a monthly basis on its website in the Closed-end Funds. A n ___ oversees a mutual funds portfolio and makes the buy and sell decisions. An investor may purchase or sell shares at market price.

There is a one-time public offering and once issued shares of closed-end funds are sold in the open market through a stock. Ways to decrease risks include diversifying assets using prudent practices when underwriting and improving operating systems. The following Eaton Vance closed-end funds the Funds announced distributions today as detailed below.

An investment in a fund is subject to risk including the risk of possible loss of principal. Unlike the open-end fund a closed-end fund has a limited number of shares outstanding and trades on an exchange at the market price based on supply and demand. A funds shares may be worth less upon their.

Management Slashes Contingency Reserve. The major risks faced by banks include credit operational market and liquidity risks. Ad Explore Closed End Mutual Funds.

Insufficient Contingency Reserve Budgeted. Declaration 712022 Ex-Date 78202.

Is It Time To Consider Muni Closed End Funds Blackrock

Is It Time To Consider Muni Closed End Funds Blackrock

Reits Vs Real Estate Mutual Funds What S The Difference

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Thornburg Strategic Income Fund Thornburg Investment Management

Is It Time To Consider Muni Closed End Funds Blackrock

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

Is It Time To Consider Muni Closed End Funds Blackrock

Federal Register Enhanced Disclosures By Certain Investment Advisers And Investment Companies About Environmental Social And Governance Investment Practices

Federal Register Securities Offering Reform For Closed End Investment Companies

Understanding Closed End Vs Open End Funds What S The Difference

Closing Mutual Funds Investment Protection Or Trap

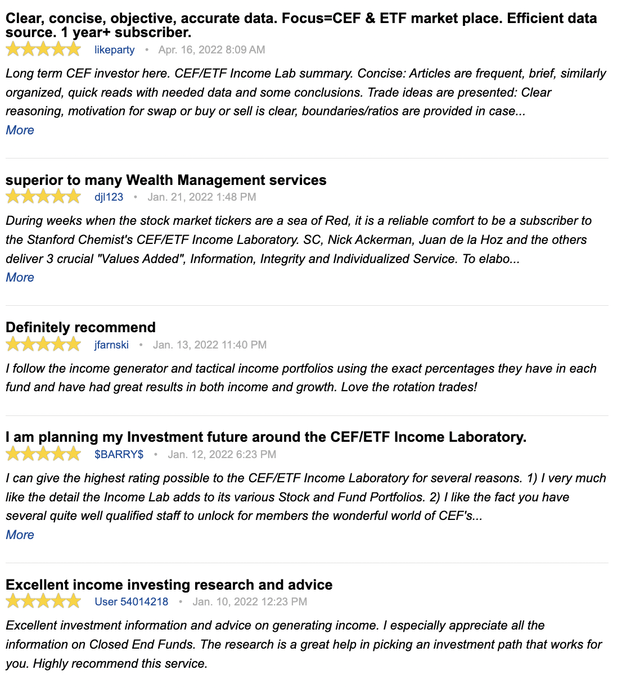

Cef Etf Income Laboratory Marketplace Checkout Seeking Alpha

What Is The Difference Between Closed And Open Ended Funds Quora

Ppt To Understand What Are Mutual Funds For Bba Finance And Mba Finance Students Powerpoint Slides

What Is The Difference Between Closed And Open Ended Funds Quora

/155571944-5bfc2b9646e0fb005144dd3f.jpg)